THE BUY-SIDE COMP SHEET

One of the saddest things about leaving an institutional hedge fund is loads of your infrastructure gets locked away forever. Well, I'm on a journey to rebuild many of my investment process architecture tools to try to give our students & clients some examples of tools that have been helpful to me.

Doing this job well is about effective information distillation and process velocity; properly constructed tools can help a lot.

I wanted to talk first about the concept of a comp sheet.

I've seen content on how to build an investment-banking-style trading comps or transaction comps sheet, but, for the most part, public equity investors have to figure out how to adapt this approach to create something useful on their own. What I'm sharing here are things I've picked up over 15 years working with comp sheets.

With the caveat that there is no absolute "best practice" here, I'd like to give you some elements of my comp sheets that have been helpful to me over time.

First, WHY use a comp sheet?

A properly constructed comp sheet can be a great tool for triage in both idea generation & answering the critical question of how I'm going to spend my time this week. Alpha lies in the "exceptions", and a well constructed comp sheet can help you find those exceptions.

A comp sheet is helpful for systematizing pattern recognition, sniffing out change & inflection and identifying under-appreciated fundamental shifts in your coverage. Whether you are a generalist distilling information on 500 stocks or a specialist staying current on 50 stocks, I always found spending some time with a comp sheet each week was a critical part of my process (I usually did about a 30m scan before our Friday idea spitball lunch).

Comp Sheet Dimensions

I will walk through a few areas I like to include in my comp sheet. One point I want to make - there is no magic formula for investing. There may be alpha in the 52wk high list or the 52wk low list. There may be alpha in the highest EV/EBITDA or the lowest EV/EBITDA stock on your page. The use of a comp sheet is more about noticing interesting patterns that stimulate further exploration, to stimulate a "hunch".

I'll assume I don't need to explain to this audience the basic metrics in this sheet like price, MCAP, EV, 52wk high/low, and simple valuation pulls (for FE, we will be building a detailed video walk-through at some point), so I will skip the Comp Sheet 101 here.

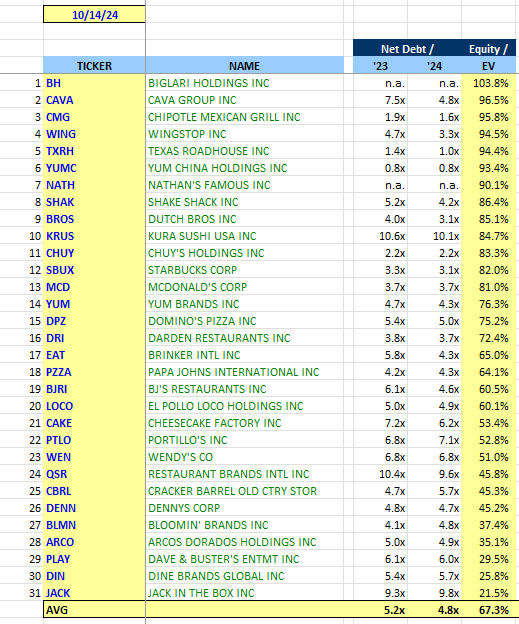

I'll highlight a few areas here from a comp sheet on restaurants. One caveat - typically I go through a "bucketing" process on my comp sheets and have different sections for quick service, casual dining, company owned, franchised, etc. Given I'm using this as a teaching tool, I haven't done that bucketing process here.

BALANCE SHEET & EQUITY STUB

In evaluating stocks within a sector, equity composition of enterprise value is a key consideration. A net cash company requires a different investment process than a 20% equity stub with 10x of leverage. They require different lenses on valuation. I want to be able to see that efficiently in my comp sheet.

Here, JACK and DIN will require a different investment lens than CAVA or WING. Some may fit in your process stylistically and others may not. I will want to orient my investment process around the balance sheet & distributable FCF in a much more intentional way.

POSITIONING

In a comp sheet, I want to see where a fight is breaking out. I like to look at short interest momentum and hedge fund ownership momentum. The collective group of shorts either pressing or retreating is information-laden in my process. Personally, I like to look for ideas where both the shorts are pressing and hedge funds are buying, like a PLAY.

Probabilistically, when shorts are pressing and the hedge funds are retreating, the bar for a position just is raised a couple notches, and I want to be clear and intentional that idea is a contrarian flow.

ESTIMATE MOMENTUM

I like to see the general trajectory of sell-side consensus estimates. This trajectory gives me a clue about the current business momentum and tells me if we are in a "beat & raise" or a "miss & lower" pattern. These patterns can have legs as the popular saying "the first miss isn't the last miss" captures.

Many sectors tend to follow earnings revisions, so this gives me a quick & efficient view on where there is current strength vs. weakness.

A caveat...the anticipation of revisions will be more deterministic to alpha than the current momentum, so this is just a starting point.

CORE FORMULA

I like to break things down to what I call the "core formula" of EPS vs. P/E. How much of the stocks move YTD has been due to NTM EPS estimate progression (roll-forward & revision) vs. P/E expansion. The general view is that estimate progression is more durable than multiple expansion (not always true).

Particularly for big moves like a WING, it is helpful to see that just around all of the stocks move YTD has been due to estimate progression, not multiple expansion (this isn't me expressing a view won the fairness of WING's 90x P/E).

Particularly on the short side of the book, I very rarely want to step in front of a large magnitude of positive revisions ("valuation shorts" can be a fatal & rookie mistake).

Again, this sheet just tells me the set-up and steers me on my research journey.

BASE RATE INCREMENTALS

As risk of the sell-side learning what an incremental margin is (half joking), I have talked about the power of thinking about businesses on an incremental margin basis.

I like to look at two dimensions of incrementals in a comp sheet.

1) where are run-rate incrementals (i.e. trailing 3 year incrementals) relative to base margins. Incrementals mathematically give a "preview" of future base margins (pace determined by speed of revenue growth). A big gap in current incrementals vs. current base margin gives me a clue about the margin potential here.

2) run-rate incrementals vs. street expected incrementals. If, say, incrementals have been running at 40% and street expects those to compress to 20%, I would want to dig in and understand if that is a street mis-modeling.

And for any sell-side analysts reading this, please keep modeling on a flat-line bps basis, thanks much 🙏

THAT'S ALL FOR NOW

This was just a flavor of some of the more advanced 201 or 301 concepts I like to include in my comp sheets. There all sorts of other bells & whistles you can add too. For a client, we are working on a process infrastructure series, and a more exhaustive How to Build & Use a Comp Sheet will be a module in our training catalogue, but I didn't want all of that to be behind a paywall. I hope that a few things I discussed here will shorten your journey to creating a useful comp sheet.

If this is a deeper training your team/firm may find interesting, please e-mail me at brett @ fundamentedge(dot)com.

WILL I SHARE THE EXCEL?

Sure, why not? Click the link below to download FactSet, CapIQ, and Bloomberg Comp sheets

Have a great day.