Capacity Constraints at Multi-Manager Funds

I've *generally* thought that $40-60bn of gross exposure in a vacuum is a reasonable scale for an equity long/short business.

How do I get there? Firms think about silos differently, but let's call it 6 core industry buckets with 4-6 discrete sleeves in each industry. With relatively concentrated sleeves in each sub-industry of 10 longs by 20 shorts, I can run a portfolio of 40 longs by 80 shorts. If my 120-stock portfolio is chosen from a universe of 250-300 liquid ideas, I should be able to find good ideas without overly watering down my portfolio (i.e. I am picking the best 40 longs out of 300 potential names). And despite running 120 names, by calibrating my sizing I can ensure a bulk of capital is in my best ~10-15 longs and my best ~20-30 shorts.

If my average ADV in my portfolio is $125m (out of ~300 stocks covered that will have to include mid-caps) and I am running $2.5bn gross ($1.25bn per side) and 40 longs by 80 shorts, my average long is $31m.

At this scale, it is taking me 8 days to liquidate a position in an orderly fashion (i.e. 3% of ADV) and 3-5 days taking material but not massive slippage. So, I'm fairly liquid. This GMV scale does start to limit my capacity in less liquid names...when you are 0.5x-1.0x ADV it can be more painful to enter & exit a position (a 10% position size that is 1x ADV can take 33 days to equity in an orderly fashion). So in the 0.5x-1.0x ADV range you raise your portfolio risk of disorderly slippage.

Generally, due to 1) capacity / overlap risk, and 2) corporate access reasons, many pods historically have limited the number of teams per silo. Some run larger teams with bigger sleeves, others run more teams with narrower sleeves. But, generally, few have wanted to have 10+ teams covering the exact same stocks, as 10 teams running similar portfolios raise the risk that the roll-up means there are many names where the firm owns 5x+ ADV. At ~$50bn, 3 teams per silo, and some diversity in teams, this limits the roll-up risk of ADV.

So that's how I would think about capacity on a firm by firm basis. Certainly there will be situations where one security has an elevated ADV on a roll-up basis, but at $40-60bn GMV that seems manageable (and hedge-able).

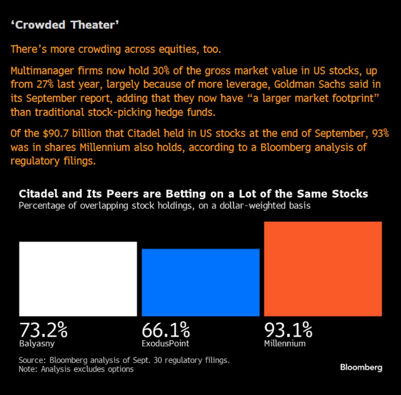

Now the much trickier part is how to think about strategy capacity outside the four-walls of a multi-manager fund. I might be responsible in capping capacity, but with the evolution of spin-outs & more competitors (most who think about ideas & portfolio construction in a very similar way), that raises the risk. $50bn deployed in one strategy all of a sudden turns into $500bn deployed in that same strategy, and the popular trades are loaded with 10-15x ADV. Exacerbated by back-books and quant overlay strategies. That's the tinder box that I think is the concern. And why an acute eye as a PM to identify & avoid late-stage positioning is so key (mindset I generally espouse to MM professionals: you want to accrue positioning and enjoy the influx in which compresses the alpha load, then exit when signs appear of over-crowding).

What's the exact capacity number? Really hard to say. But my general feeling is we are there (i.e. $500bn+ in equity market neutral L/S is too much). And handling this crowding dynamic and the episodic resulting unwinds that come from this new normal will be an existential and critical muscle for sustained outperformance by the multi-managers. Will it compress MM returns? Not sure. Quants have been dealing with capacity concerns in core strategies for decades as more and more capital has flowed into look-alike strategies. Most of the big quants, while returns have certainly compressed, have found a way to adapt & evolve, sustaining pools of alpha and finding new pools of alpha. Hence why I take the under on the "peak pod" thesis, but recognize that with more crowding, new firms without the same risk DNA as established firms, and high levels of leverage. My hunch is there will be some interesting developments here in the next 18 months. We shall see.